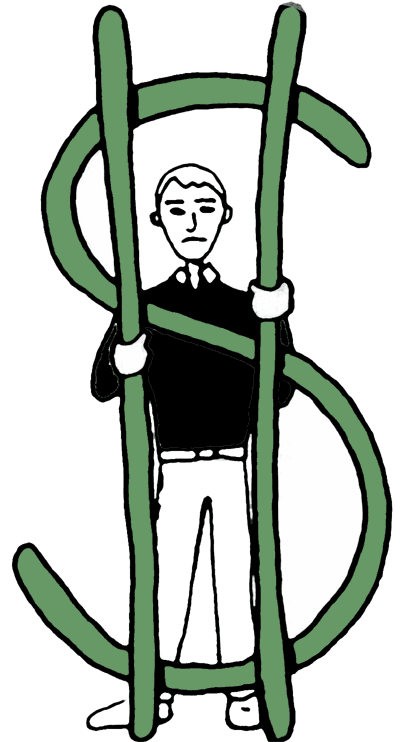

The European Union finance ministers are still searching for a solution whether and how to recuperate the cost of the crises from the European banks.

The European Union finance ministers are still searching for a solution whether and how to recuperate the cost of the crises from the European banks.With regard to how to charge banks for the costs of crises, the opinions are divided. Most ministers agree on making an extra levy on the banks, the issue is however on the one hand where the proceeds should go to and on the other hand what the levy should be based on. The big obstacle remains the fear that not every country will implement the decision.

http://www.nytimes.com/reuters/2010/10/01/business/business-us-eu-banklevy.html?_r=1&dbk

Isabeau Haelterman